Today's Events

Monday, March 9, 2026

Charles Houska: Master of Play

From: Monday, January 12, 2026

Until: Sunday, April 5, 2026

10:00am - 5:00pm

Where:

St Louis, MO @ World of Chess Hall of Fame and Galleries

Posted by Local Resident in Events

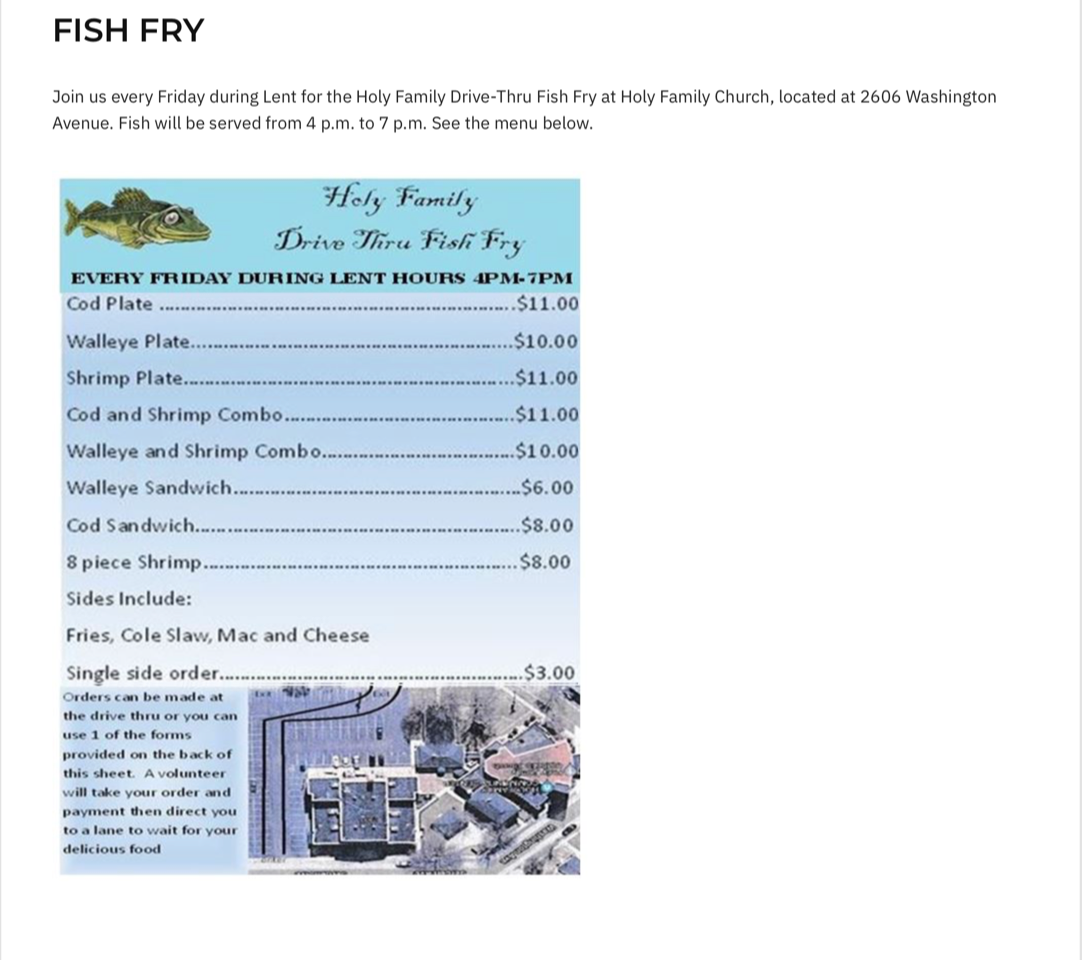

LENTEN Drive-Thru Fish Fry

From: Friday, February 27, 2026

Until: Friday, April 3, 2026

4:00pm - 7:00pm

Where:

Granite City, IL @ Holy Family Catholic Church, 2606 Washington Avenue

Posted by Local Resident in Events

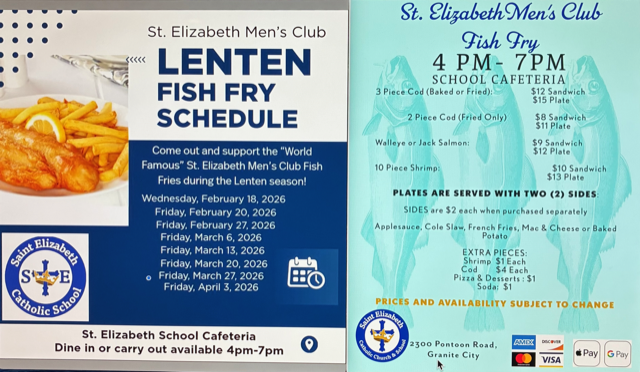

LENTEN Fish Fry

From: Friday, February 27, 2026

Until: Friday, April 3, 2026

4:00pm - 7:00pm

Where:

Granite City, IL @ St. Elizabeth School Cafeteria, 2300 Pontoon Rd

Posted by Local Resident in Events

Mark your calendars! The following events were added to the CityPages recently

RIDIN THE STORM OUT and DREAM POLICE

Saturday, March 21, 2026 8:00pm - 10:00pm

Where:

Granite City, IL

@ The Mill 1311 E. 20th Street

Posted by Local Resident in Events

SOMEBODY TO LOVE BAND

Friday, March 20, 2026 8:00pm - 10:00pm

Where:

Granite City, IL

@ The Mill. 1311 E. 20th Street

Posted by Local Resident in Events

The South Side Johnny Band

Saturday, March 14, 2026 8:00pm - 10:00pm

Where:

Granite City, IL

@ The Mill 1311 E. 20th Street

Posted by Local Resident in Events

Recent Discussion Activity

| Topic | Category | Replies | Views | Last Activity |

|---|---|---|---|---|

|

Please Welcome Liberation Contracting and Roofing

by Local Resident · All Communities · Friday 1:29pm |

CityPages Announcements | 0 | 500 | Friday 1:29pm |

|

The Real Estate Elephant in the Room.

by Illinois Only Resident · Illinois Only · Mar 1, 2026 5:07pm Verified Business: George Sykes, Managing Broker, Worth Clark Realty |

Specials & Offers | 0 | 869 | Mar 1, 2026 5:07pm |

|

New Listing: 2653 Grand Avenue, Granite City, Illinois 62040

by Local Resident · All Communities · Feb 27, 2026 9:25pm Verified Business: George Sykes, Managing Broker, Worth Clark Realty |

Specials & Offers | 0 | 1180 | Feb 27, 2026 9:25pm |

|

Satirical Minutes from the Emergency Meeting of the Six Mile Prairie Horseshoe Guild

by Local Resident · All Communities · Feb 25, 2026 10:57am |

Funny Stuff & Jokes | 0 | 1383 | Feb 25, 2026 10:57am |

|

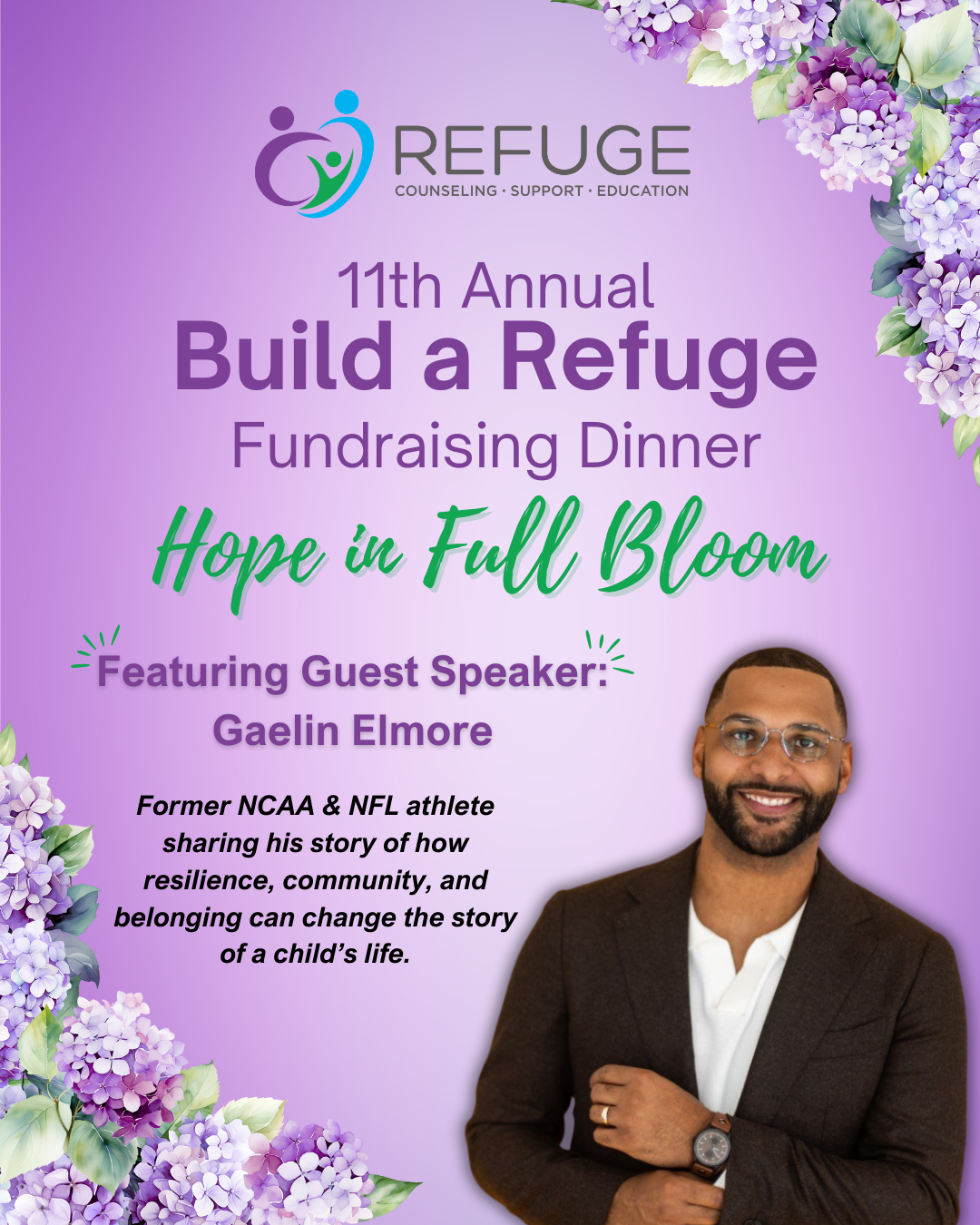

Refuge Announces Former NCAA & NFL Athlete Gaelin Elmore as Guest Speaker for 2026 “Build a Refuge” Fundraising Dinner

by Local Resident · All Communities · Feb 24, 2026 11:08am Verified Business: Refuge |

Press Releases | 0 | 1246 | Feb 24, 2026 11:08am |

|

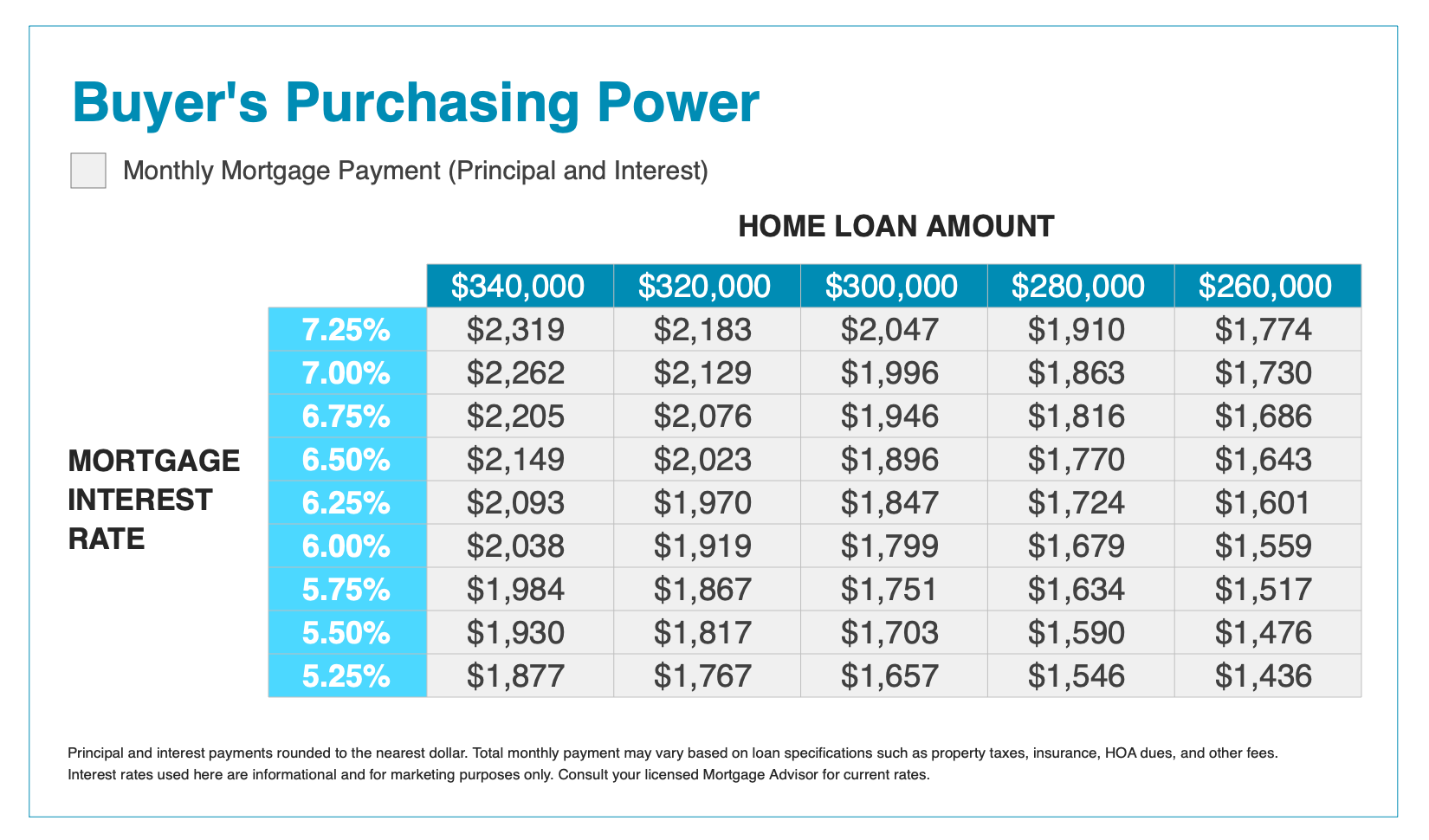

Do interest rates really matter when buying a home?

by Local Resident · All Communities · Feb 18, 2026 10:14am Verified Business: George Sykes, Managing Broker, Worth Clark Realty |

Industry Advice | 0 | 1667 | Feb 18, 2026 10:14am |

|

Grime Stoppers

by Local Resident · All Communities · Feb 10, 2026 2:57pm |

CityPages Announcements | 2 | 2175 | Feb 17, 2026 2:05pm |

|

Granite City Girls Varsity Basketball Move On

by Local Resident · All Communities · Feb 14, 2026 10:08pm |

Sports | 1 | 1829 | Feb 16, 2026 7:51pm |

|

Nano Paradox Multi-Purpose Cleaner for Restaurants

by Local Resident · All Communities · Feb 16, 2026 2:54pm |

CityPages Announcements | 0 | 2022 | Feb 16, 2026 2:54pm |

|

Prescription Eye Glass Donations

by Local Resident · All Communities · Feb 14, 2026 12:40pm |

Free Stuff | 0 | 1773 | Feb 14, 2026 12:40pm |

Brokered by: Coldwell Banker Brown Realtors

Brokered by: Coldwell Banker Brown Realtors